Like many who have been active in the New York startup ecosystem over the past decade, I am optimistic about its future. The last 10 years have seen an increasing number of startup successes in New York — Shutterstock, Tumblr, AppNexus, Gilt Groupe, MongoDB, Etsy, Buddy Media, Warby Parker, Kickstarter, Gerson Lehrman, and OnDeck Capital to name some, with many others on the rise. Venture and angel funding are increasing, large internet companies including Google and Facebook are growing their New York offices, and Cornell and Technion are collaborating to build a large engineering campus on Roosevelt Island.

Like many who have been active in the New York startup ecosystem over the past decade, I am optimistic about its future. The last 10 years have seen an increasing number of startup successes in New York — Shutterstock, Tumblr, AppNexus, Gilt Groupe, MongoDB, Etsy, Buddy Media, Warby Parker, Kickstarter, Gerson Lehrman, and OnDeck Capital to name some, with many others on the rise. Venture and angel funding are increasing, large internet companies including Google and Facebook are growing their New York offices, and Cornell and Technion are collaborating to build a large engineering campus on Roosevelt Island.

As optimistic as I am, it’s always useful to check one’s optimism with data. The data takes some work to pull together, and not all of it is public, but when one does pull it together, it paints a very promising picture, one showing that New York has been the fastest-growing technology startup ecosystem in the country over the past 10 years and now ranks second behind Silicon Valley in all key metrics.

These trends suggest strong continued momentum for New York, but if one really wants to get a good sense of where the ecosystem is going, it’s important to take a close look at the primary factors driving its growth. Other technology startup ecosystems have had periods of rapid growth only to slow down substantially when the macro factors driving their growth dissipated.

A close examination of the macro factors driving New York’s growth suggests that the ecosystem is still in the early stages of its development and that its rapid growth will likely last for many years to come.

The Growth in Venture Financing

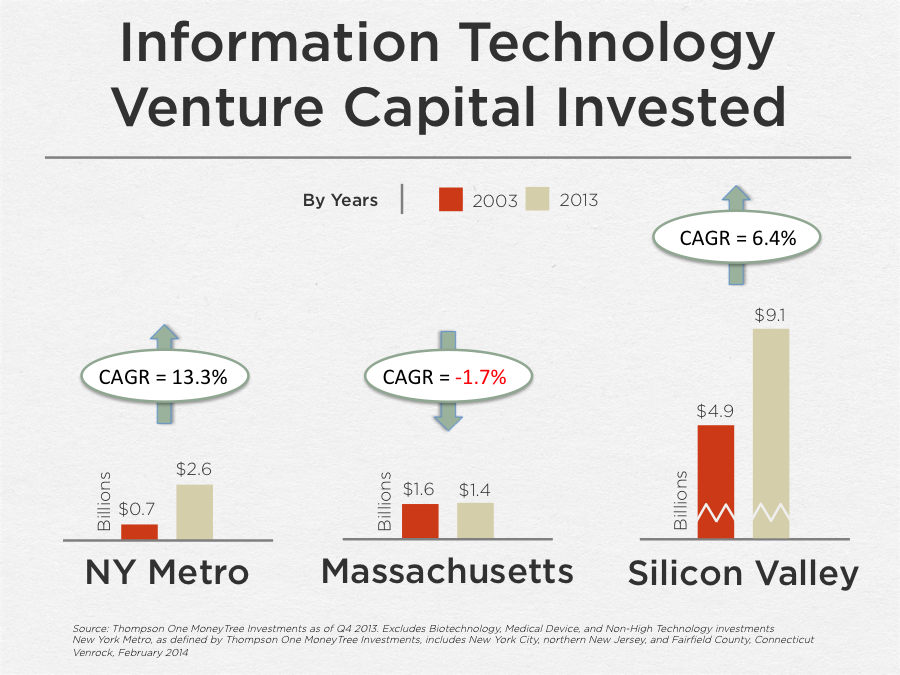

So how big, exactly, is New York’s technology startup ecosystem, and how quickly is it growing? The best proxy for the size of a startup ecosystem is the total amount of venture capital invested in it. Judged this metric, New York has been the fastest-growing technology startup ecosystem in the U.S. over the past 10 years and currently ranks #2 in the country behind Silicon Valley:

With $2.6 billion in venture capital invested in 2013, New York’s technology startup ecosystem is currently 87% larger than that of Massachusetts and 28% the size of Silicon Valley.

At first glance, this analysis appears to run counter to the public MoneyTree and National Venture Capital Association reports – the sources of almost all articles and blog posts on venture investment levels – which show New York continuing to trail Massachusetts and New England more broadly as the third largest startup ecosystem in the country. In fact, however, it is based on the same data as these reports, but it uses categories better suited to measure the relative size of the New York technology ecosystem.

The primary challenge with the MoneyTree and NVCA reports is that they lump together venture investments in information technology and healthcare, making it difficult to compare information technology startup ecosystems on an apples-to-apples basis.

In addition, these reports tend to focus on state-based analyses, which don’t work well for New York, since New York City is located in the very southeastern corner of the state, with the result that important parts of the New York technology ecosystem are located in areas adjacent to New York City in northern New Jersey and southern Connecticut.

As a result of both factors, while these reports have partly captured the rise of New York startup ecosystem, they have missed the big story that the New York technology startup ecosystem is now by a significant margin the second largest in the country.

The Growth in Large Exits

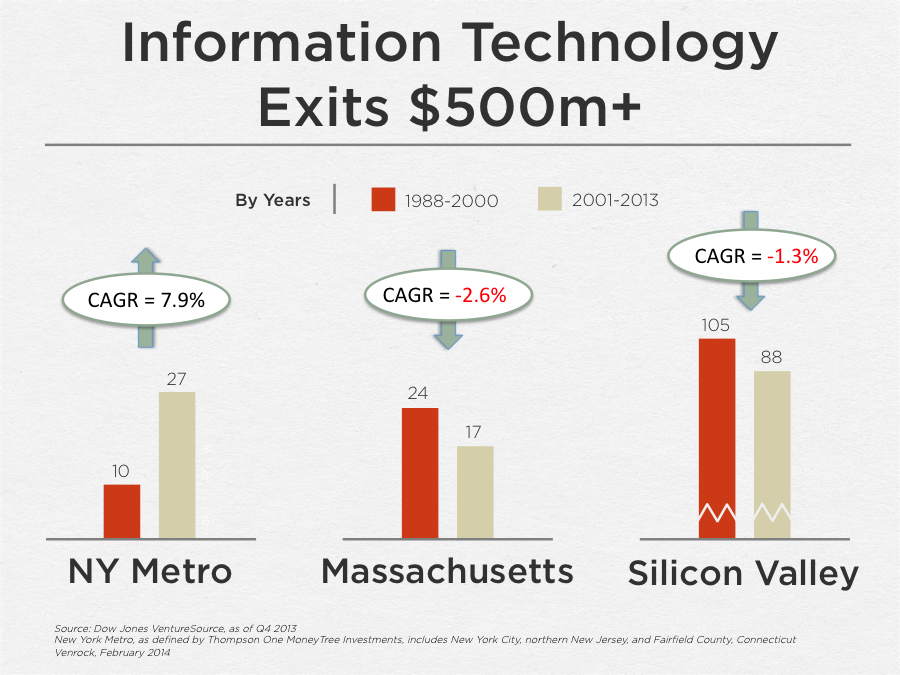

Another important metric in measuring the size of a startup ecosystem is number of large exits it produces, since this is the closest approximation of the aggregate economic value the ecosystem creates. This is a particularly interesting metric because it’s often predictive of future growth, given that companies that achieve large exits tend to be the best breeding grounds for the next generation of entrepreneurs and startup executives.

How large is large? For the sake of this analysis, let’s say $500 million or more, since this is large enough to require that startups have strong management teams and have demonstrated an ability to scale meaningfully, but small enough to yield a statistically significant sample size. Judged by this metric, the New York technology ecosystem has almost tripled in size from the generation of companies built before the internet bubble burst to the generation built afterwards:

Equally interesting is that New York has had 27 exits over $500 million since 2001, 59% more than Massachusetts and 31% the number of Silicon Valley.

Judged by either the amount of venture capital invested or the number of large exits, New York has emerged pretty definitively as the second-largest technology startup ecosystem in the country.

These trends suggest strong continued momentum for New York, but they are only partially predictive of future growth. Sometimes startup ecosystems slow down significantly when the major trends driving their growth go into reverse.

One recent example is the impact that the dramatic slowdown in demand for communications equipment had on the Massachusetts technology ecosystem after 2001 following a bonanza of communications investment and startup exits associated with the buildout of the internet and the deregulation of the telecom industry in the late 1990’s.

Communications equipment was responsible for more than half the venture capital invested in Massachusetts in the 1990’s and produced the significant majority of the state’s large exits. The sudden drop in demand in this market after 2001 put a major dent in the number of large exits Massachusetts produced since 2001 and, more gradually, in the amount of venture capital invested in the state.

So historical growth in large exits is only partially predictive of future growth. To make the best assessment of how quickly the New York technology ecosystem will likely grow going forward, it’s important to take a close look at the major factors driving its growth and understand if and how these factors may change.

The Big Catalyst that Unlocked New York’s Growth

The big catalyst that unlocked the growth of the New York startup ecosystem was the shift in innovation after the 2000-2001 crash from infrastructure to build out the internet to services that sit on top of it.

Prior to the 2000-2001 crash, New York had made a modest debut on the startup scene with the emergence of a handful of successful online advertising and marketing companies (DoubleClick, 24/7 Real Media, Linkshare), online media companies (About.com, iVillage, TheKnot), online recruitment companies (Dice, HotJobs) and fintech companies (Datek, Multex). It lacked a large engineering research university like MIT or Stanford, however, and was not competitive in the hot communications, infrastructure and enterprise software markets of the day.

After 2001, however, the cost of bandwidth, processing power and storage dropped dramatically, and reliable open source computing stacks began to emerge, making it increasingly cheap and easy to launch web services. As broadband penetration increased, the internet became a much more powerful communication and distribution network. With the advent of paid search and social networking, it became easier than ever for web services companies to find new users and customers. What followed was a period of explosive growth for a new generation of web services – both consumer and enterprise – that took advantage of these new technologies.

The Urbanization of Startup Ecosystems

This innovation shift from infrastructure to services had profound implications for New York, and indeed for major cities everywhere. Since technology was much easier and cheaper to deploy, it meant that business and product ideas could drive innovation as much as technology ideas and that one didn’t have to be a technologist to start a technology-driven company.

This led to a significant increase in the number of credible entrepreneurs who could start technology-driven companies, be they creative urban hipsters with social product ideas, aspiring business school graduates seeking to disrupt existing industries or vertical industry veterans with ideas to solve industry problems with information technology. This shift substantially favored big cities.

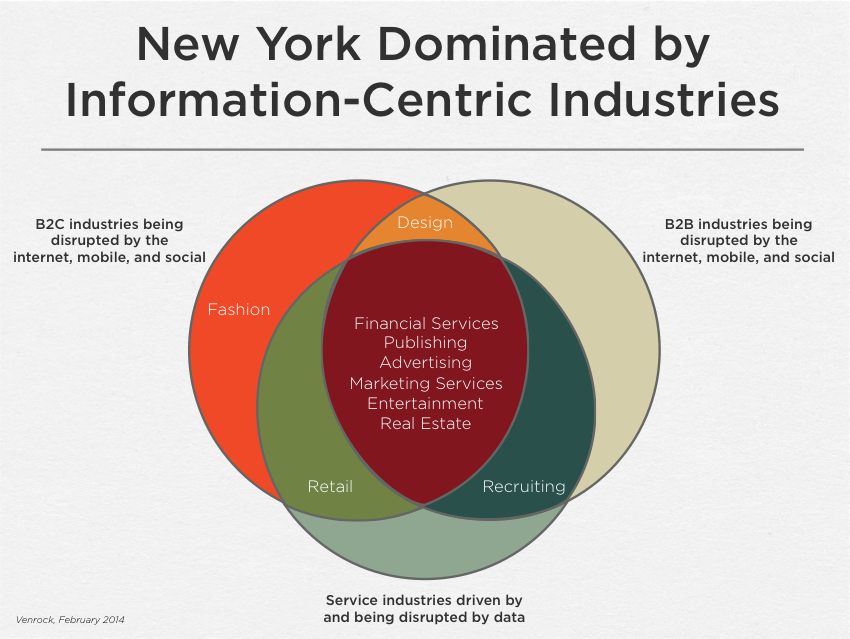

Equally important, these new web services had their biggest impact on information-centric industries, which tend to cluster in big cities. These include financial services, advertising, marketing services, publishing, entertainment, real estate and design. These industries are all driven by information, and their end products are partly or totally digital.

These industries are in the midst of historic disruptions based on two factors: (1) the growth of the internet – including its social and mobile extensions – as a new network for marketing, selling and distributing their products and services and (2) the availability of massive amounts of new data generated by these industries, their customers and third parties that are relevant to them.

As the disruption of these industries has accelerated, many of the startups disrupting them have emerged in New York and other big cities, as that’s where the primary talent pools and customer bases for these industries are.

This broad urbanization of startup ecosystems has been visible not only in the rise of New York and other big cities that had not previously been major technology innovation centers – including London, Berlin, Beijing, Shanghai, and San Paulo – but also in the shift in the center of gravity of established technology ecosystems toward urban centers, including from Silicon Valley to San Francisco and from Route 128 to Cambridge.

New York Takes Off

No city has been impacted by these changes as much as New York. Suddenly many of New York’s great offline business advantages became meaningful advantages for the growth of its digital startup ecosystem. New York is the largest U.S. city by more than a factor of two. It is the world capital or a leading city for some of the largest information-centric industries and consumer industries in the world: financial services, advertising, marketing services, real estate, publishing, entertainment, retail, recruiting, fashion and design among others.

New York is a place – often the place – where people from all walks of life go to make it in these and other industries and as a result has arguably one of the highest concentrations of ambition per capita of any city in the world. And given its unusual concentration of people, industry, talent and ambition, it is one of the greatest creative centers the world has ever seen in both the business and cultural fields.

After 2001, New York saw the emergence of a new and substantially larger set of digital companies in the major industries it dominates. In adtech, a large new group of companies emerged to take advantage of the rapid growth in online traffic and in the profileration of new media, advertisers, devices, ad formats and targeting data, cementing the city’s position as the leading city for pure adtech (i.e. adtech not connected to large consumer applications such as Google, Facebook or LinkedIn). Notable in this group are AppNexus, Right Media, Admeld, MediaMath, Vibrant Media, Tremor Video, Quigo, Tacoda, Outbrain, Intent Media, Dstillery, Integral Ad Acience, Evidon and Moat.

A large set of new fintech companies emerged after 2001, including not only products and services for the financial services industry such as FX Alliance, LiquidNet, Traiana, Data Explorers and Dataminr; but also new, internet-driven financial services providers such as OnDeck Capital, SecondMarket, Lenddo and CommonBond; and new consumer information services such as Learnvest, Billguard and Betterment.

Similar dynamics can be seen in other verticals where New York is strong, including marketing services (Buddy Media, Yext, Yodle), media (Huffington Post, Business Insider, Mashable, Thrillist Media Group, Buzzfeed), real estate (Compass, StreetEasy), recruiting (Indeed, TheLadders), fashion (Gilt, Bonobos, RentTheRunway, Moda Operandi) and design (1stDibs, Behance).

Reflecting the breadth of its creativity, New York has also seen a surge of successful consumer startups in a variety of areas completely different to these (Tumblr, Etsy, OLX, Warby Parker, Fancy, ZocDoc, Codecademy, Birchbox, SquareSpace, Foursquare, Meetup, Venmo) and a number of promising enterprise software companies (MongoDB, Varonis, Smartling, Conductor, SailThru) as well. It has also become an innovation leader in such diverse areas as product financing platforms (Kickstarter, Quirky, See.Me), 3D printing (Makerbot, Shapeways) and collaborative workspaces (WeWork).

The Future of the New York Startup Ecosystem

Seen against this backdrop, the future of the New York startup ecosystem looks bright. The digitization of the information-centric industries New York dominates has only just begun. Even in the absence of major new information technology advances, it would take these industries decades to take full advantage of current set of internet technologies. And of course new advances will continue to emerge.

In addition, startup ecosystems have a natural built-in multiplier effect, in that successful startups tend to give rise to multiple additional successful startups, as acquisitions take place and founders and other employees leave to start new companies. This serves to reinforce the growth of an ecosystem. Doubleclick famously has given rise to dozens of successful startups including Gilt, MongoDB, Business Insider, Right Media, Moat, Catchpoint and many others. We are starting to see similar dynamics around the current generation of successful startups in New York.

Finally, given the unprecedented range of technology tools in the hands of today’s entrepreneurs and the increasingly networked state of the world’s consumers and businesses, it is a safe bet that the creativity and ambition of New York entrepreneurs will produce an increasing number of innovative new businesses that go beyond our current imagination in areas that don’t yet have names.

Certainly New York has its handicaps as a startup ecosystem. It still does not have a major engineering research university like Stanford or MIT. Cornell-Technion will begin to change that, but it will start small, and for the foreseeable future it will only be for graduate students. Google, Facebook, Twitter, Amazon and eBay all have growing New York offices that bring increasing engineering talent into the city, but the demand for great startup engineers still far outstrips the supply. (Silicon Valley engineers, come east!)

Like San Francisco, New York is an expensive place to live. New York’s new Mayor, Bill de Blasio, has made affordable housing an important goal for his time in office. The government, however, can only do so much on housing in the face of broader economic forces. New York is, however, a very desirable place to live that tends to attract the young and talented in particularly large numbers despite the associated expense.

Despite these challenges, New York should continue to grow rapidly as one of the country’s premier startup ecosystems and should continue to do particularly well in digital startups that operate in the industries it dominates like financial services, advertising, marketing services, real estate, publishing, entertainment, retail, recruiting, fashion and design. There are undoubtedly a variety of new internet-driven giants to be built in these industries, and there is a significant chance that a good number of them will be built in New York.

And as with Etsy, MongoDB, Tumblr, Codecademy, Kickstarter, Knewton, Quirky and others, New York will likely produce innovative new companies in a range of unexpected new areas, beyond the abilities of current observers to predict.

Venrock has made a substantial commitment to investing in New York startups through its New York office. Partners currently at Venrock have invested in a variety of New York startups including AppNexus, Gilt Groupe, Dataminr, Smartling, Dstillery, Intent Media, TheLadders, Conductor and Doubleclick.

Many thanks to DJ Andrzejewski and Jonathan Salama for their help with the data analyses for this post.